Gross up formula

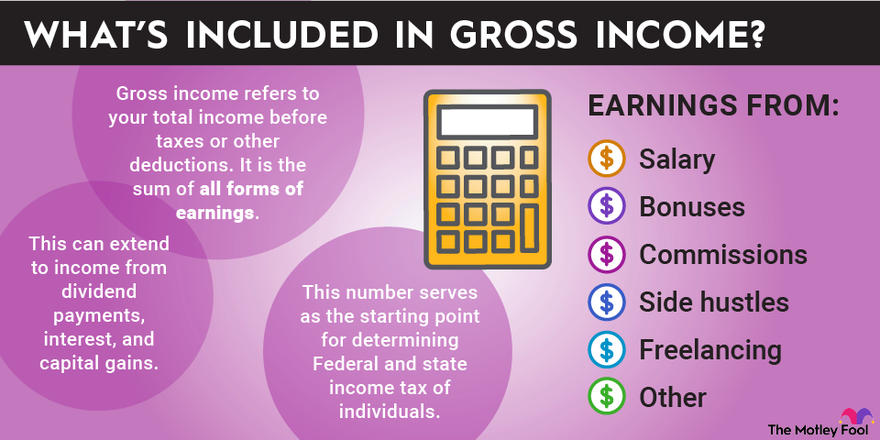

Need to know your gross wages. 1 Total Taxes Net Percent.

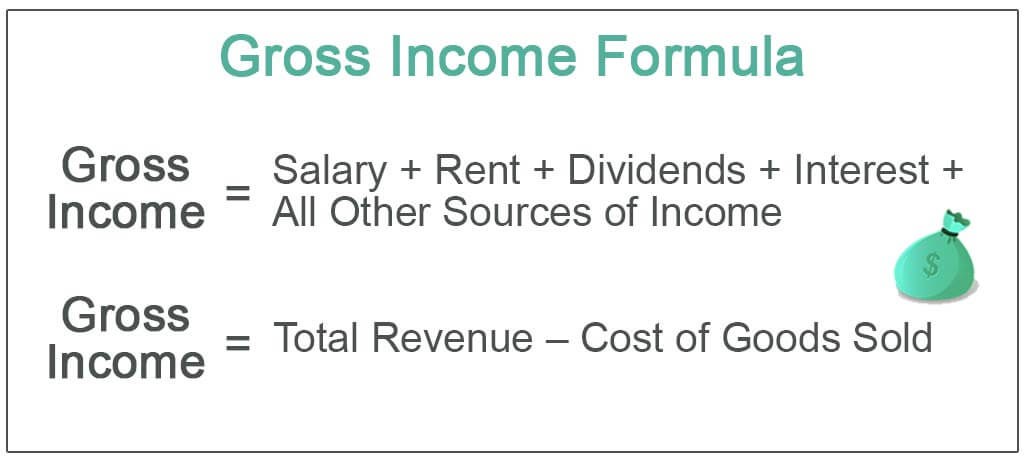

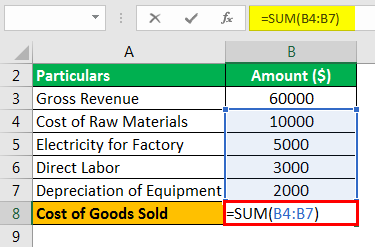

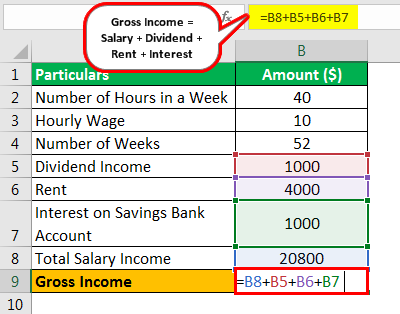

Gross Income Formula Step By Step Calculations

Como calcular o Gross Up.

. What is the gross-up formula. Grossed-Up 338 h 10 Adjustments has the meaning specified in Section 412 d iv. As a result Janes gross.

Then take the total tax rate as a decimal and subtract it from 1. Or Select a state. Gross-Up Formula has the meaning specified in Section 412 d iv.

Gross-up pay works by dividing the employees wages by the net percentage of taxes that would be due. Divide the net wages by the net percentage. For example if an employee receives 500 in take-home pay this calculator can be used to.

Vamos mostrar a seguir duas delas uma simplificada e outra mais. Use the Excelforce Services Gross Up Calculator to calculate the gross amount an employee must use for payroll taxes and how much they can take home. How to Gross-Up a Payment.

Subtract the total tax percentage from 100 percent to get the net. For example an employer may gross-up at a rate of 25 for taxable expenses. This is an estimated amount that the department needs to pay that will.

Calculate it here with a free printable report. Cant use the normal grossing up formula of 1 Adding up all federal state and local tax rates 2 Subtract the total tax rates from 100 3 Divide net payments by the net. Affordable Up to 50 less than a traditional payroll service.

Gross pay net pay 1 tax rate How do you calculate gross-up net. A gross-up clause is one that makes it clear that A has to pay such further sum as after deducting any tax leaves B with 100. Formula 1 The Flat Method The flat method uses a flat percentage calculated on the taxable expenses and then added to the income.

On the IRS Form 1042-S issued to the student the full amount of 116279 will be reported. O cálculo do Gross Up pode ser encontrado de diferentes maneiras. Department pays Gross Up Amount.

Determine total tax rate by adding the federal and state tax percentages. GROSS AMOUNT Net amount divided by 1-grossing-up rate A common example is grossing up interest for income tax or withholding tax. If the withholding tax rate is 10 the grossing up formula is.

If you want to experiment with our gross-up calculator you can calculate gross pay based upon take-home. Stipend amount 10 tax rate Total stipend payment 10 - 14 tax. The total equals the gross-up pay amount.

The formula for grossing up is as follows. Use this federal gross pay calculator to gross up wages based on net pay. To remedy the situation you can gross up Janes bonus check.

EXAMPLE Net interest is 100 and the tax rate is. Youll just need to know a few things including your net pay. This will give you the net percent.

You work backward to come up with the gross-to-net pay calculation and divide 5000 by 75. If the employee is owed 1000 the gross-up would be.

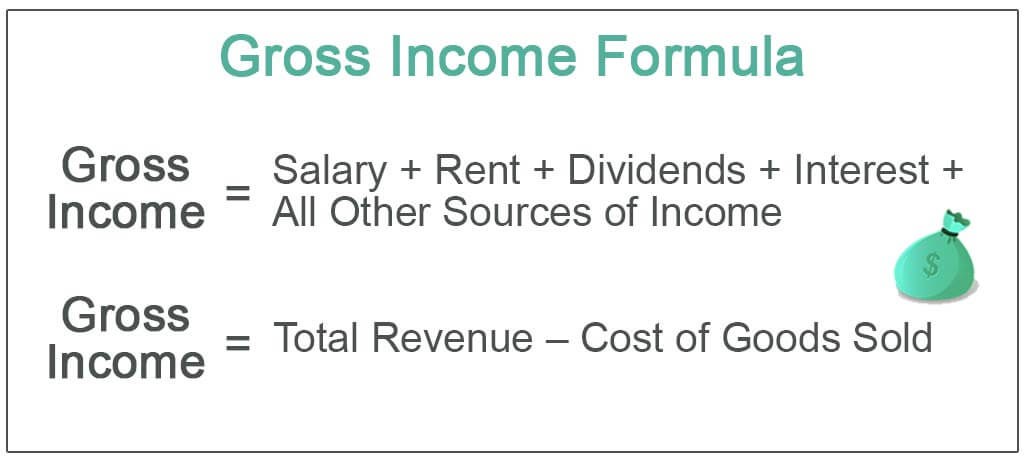

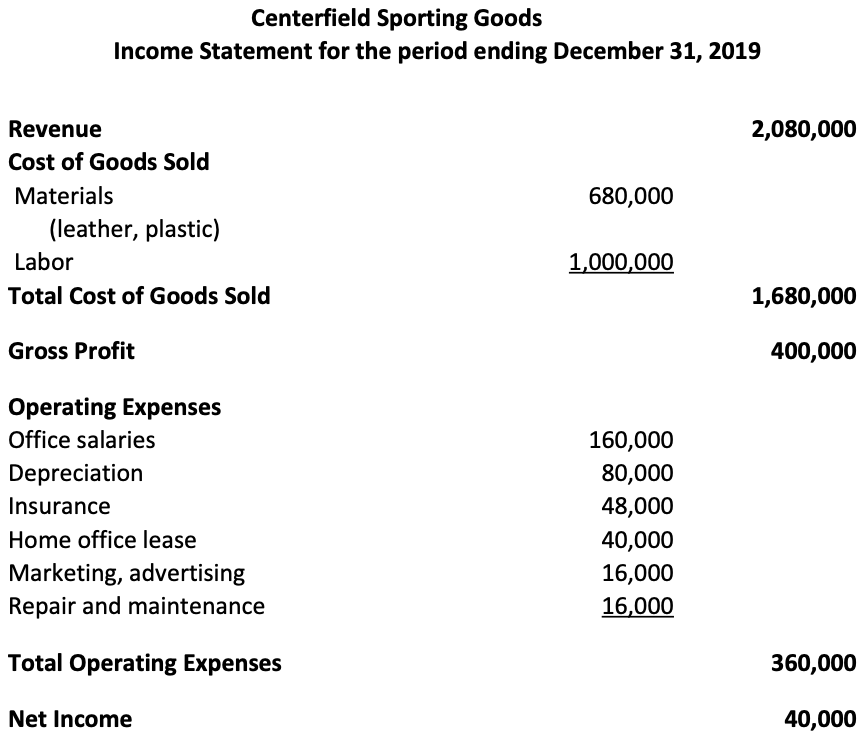

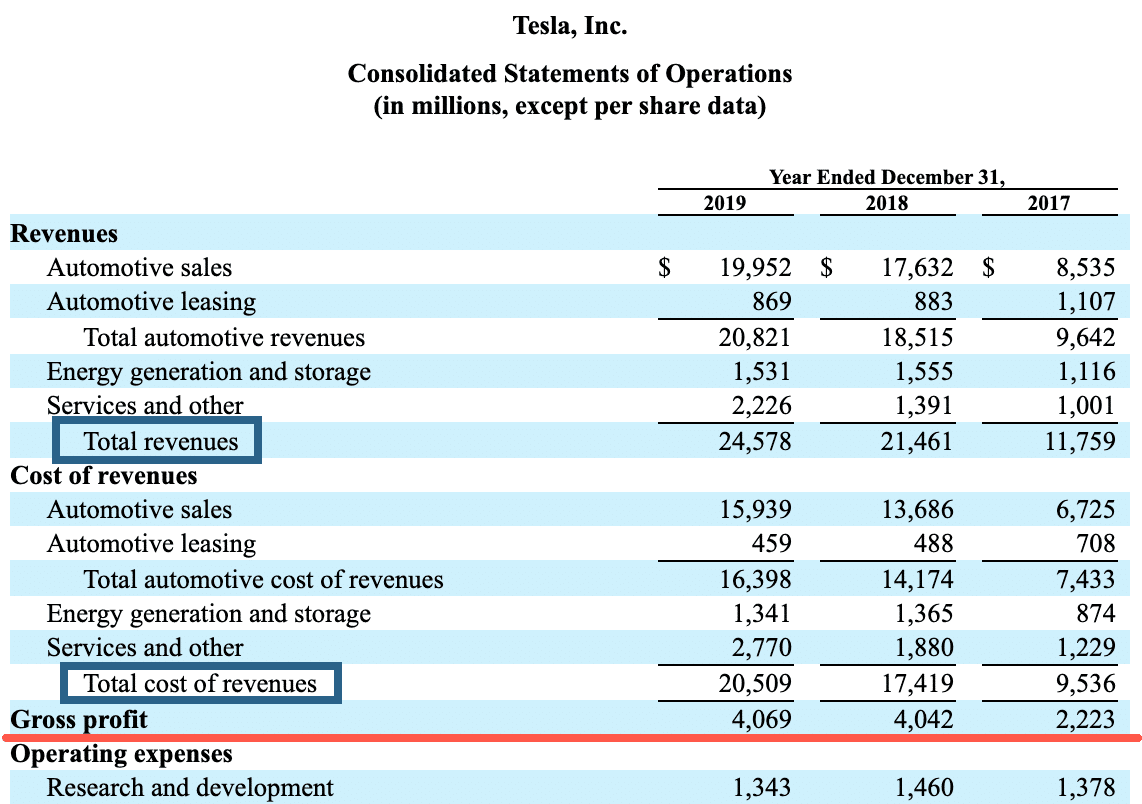

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

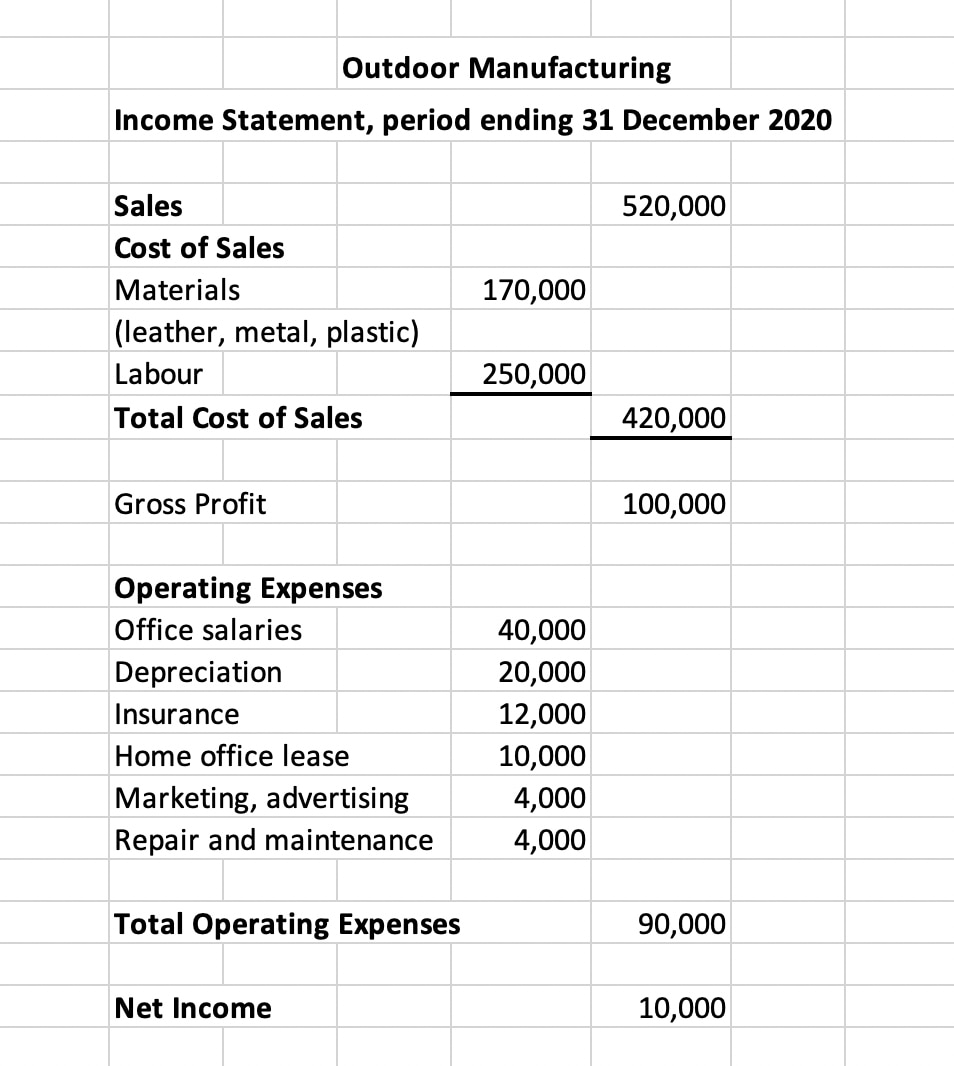

Net To Gross Calculator

What Is Gross Up Tax Gross Up Formula Definition Caprelo

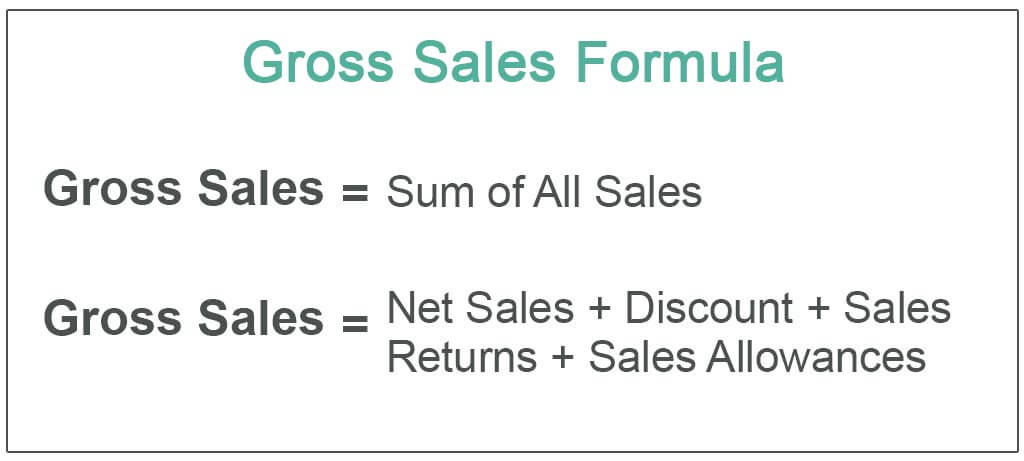

Gross Sales Formula Step By Step Calculation With Examples

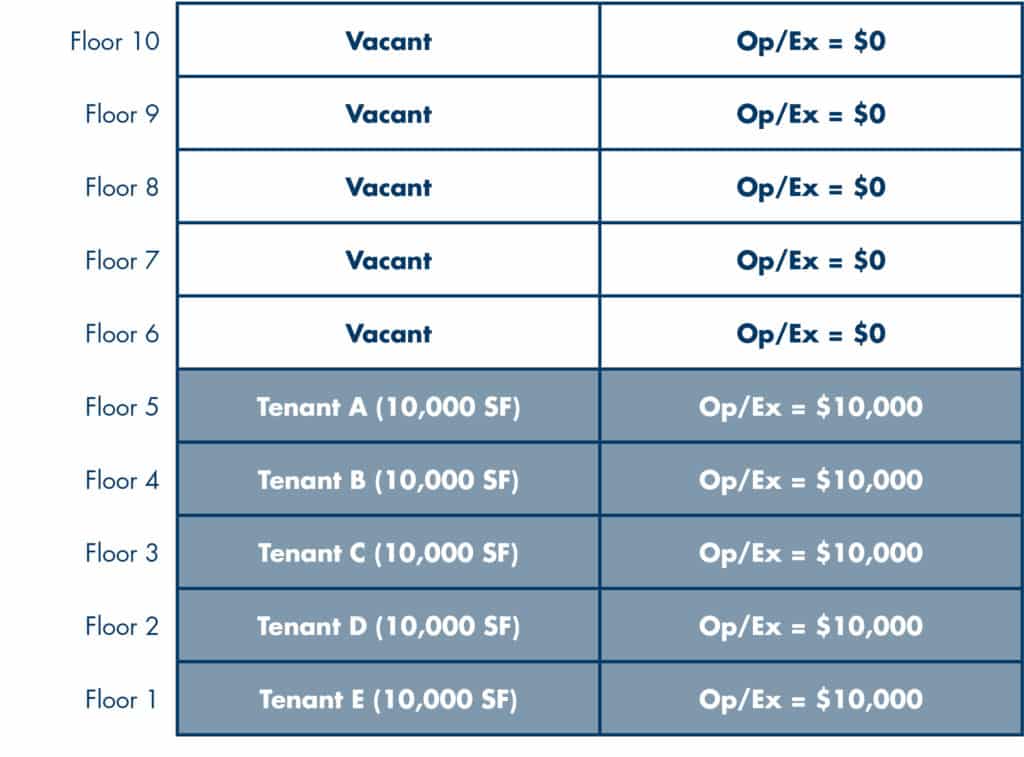

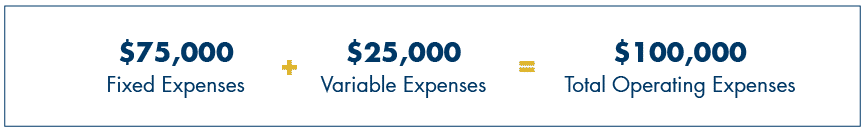

What Is An Operating Expense Gross Up Provision In A Lease

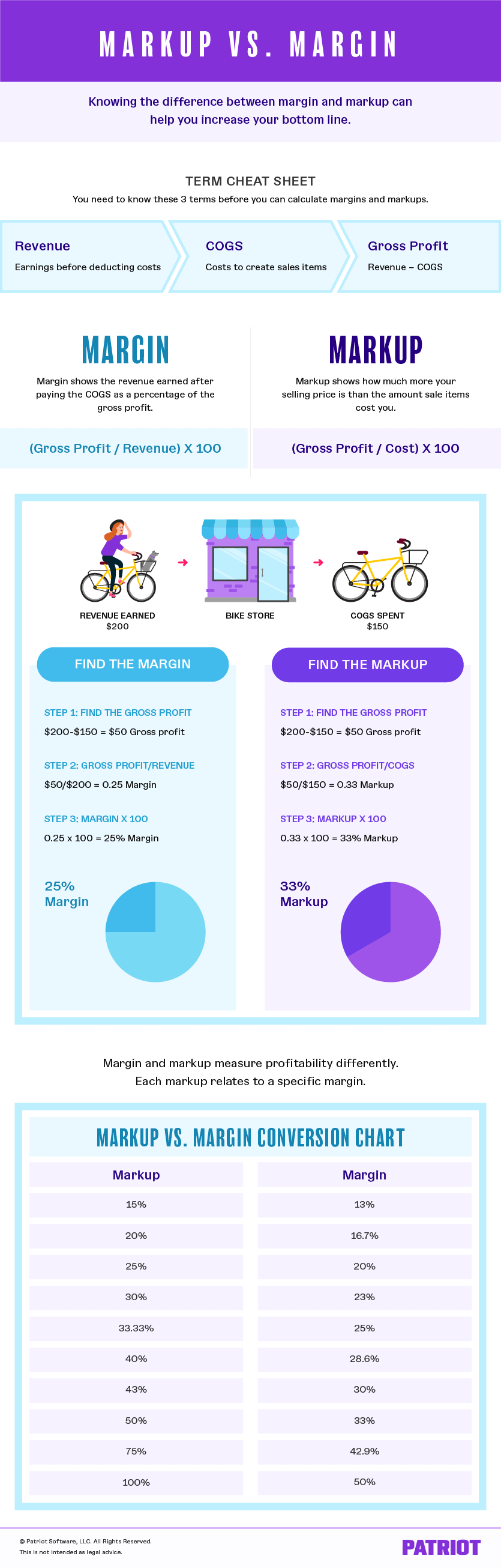

Margin Vs Markup Chart Infographic Calculations Beyond

What Is Gross Margin And How To Calculate It Article

Gross Income Formula Step By Step Calculations

What Is Gross Up Tax Gross Up Formula Definition Caprelo

How To Calculate Gross Income Per Month

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

2

Gross Income Formula Step By Step Calculations

What Is Gross Profit Definition Formula And Calculation Stock Analysis

What Is An Operating Expense Gross Up Provision In A Lease

Gross Profit Margin Formula And Calculator Excel Template

Gross Sales Formula Step By Step Calculation With Examples